No products in the cart.

The “cup” portion of the pattern should be a “U” shape that resembles the rounding of a bowl rather than a “V” shape with equal highs on both sides of the cup. Symmetrical triangles occur when two trend lines converge toward each other and signal only that a breakout is likely to occur—there is no upward or downward trend. The magnitude of the breakouts or breakdowns is typically the same as the height of the left vertical side of the triangle, as shown in the figure below. A price pattern that denotes a temporary interruption of an existing trend is a continuation pattern. Consolidation, or a sideways market, occurs where price oscillates in a range between two parallel and often horizontal trendlines. A trendline that angles up, or an up trendline, occurs where prices are experiencing higher highs and higher lows.

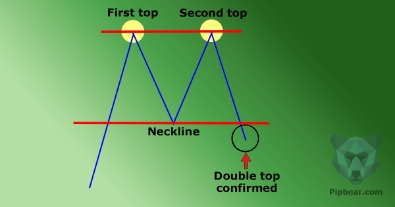

A silver investor interested only in making an intra-day trade would likely shy away from buying the precious metal based on the hourly chart price action. A double bottom pattern is a technical analysis charting pattern that characterizes a major change in a market trend, from down to up. The strongest chart pattern is determined by trader preference and methods.

Flags are continuation patterns constructed using two parallel trendlines that can slope up, down, or sideways . Generally, a flag with an upward slope appears as a pause in a down trending market; a flag with a downward bias shows a break during an up trending market. Typically, the flag’s formation is accompanied by declining volume, which recovers as price breaks out of the flag formation. Pennants are continuation patterns drawn with two trendlines that eventually converge. A key characteristic of pennants is that the trendlines move in two directions—one will be a down trendline and the other an up trendline.

Exiting a Trade

Each bar represents a specified range of price movement in either direction. Therefore, every bar has the same range and closes either at its low or high. Although the line chart doesn’t provide us with much details of the price movement in each trading sessions, it may be very useful for observing the long-term trends. In addition, since the chart is cleaner, it may be easier to see certain chart patterns, such as triangles, double tops, and wedges. Investors and long-term position traders tend to mostly make use of fundamental analysis, while short-term traders like swing traders, day traders, and scalpers make use of technical analysis. However, most of the market participants often use a combination of both.

The patterns are created by drawing trendlines that join a series of descending highs or ascending lows . Traders use trendlines to locate support and resistance areas on a price chart. A continuation chart pattern occurs when the trend continues in its current direction following a brief break, whereas a reversal chart pattern signals a change in trend direction. The top of the upper shadow represents the high price, while the bottom of the lower shadow shows the low price.

Range Bar chart

Maybe you want to use line charts for a high-level view of economic indicators, then look at bar charts for longer-term analysis of specific investments. Then you might look at a shorter-term candlestick chart for securities you’d consider adding to your investment portfolio. There are many ways technical traders recognize potential support and resistance levels. The commonest way is to draw a horizontal line connecting previous swing highs and swing lows that lie at the same level. This way, you will notice that a level can act as a support if the price is above it and act as resistance if the price is below it. Technical Analysis VS Fundamental AnalysisTechnical analysis and fundamental analysis are the two main approaches to participating in any financial market.

With an understanding of these charts, the trader will be able to make informed decisions regarding stock and other commodity markets. As with pivot point levels, there are numerous freely available technical indicators that will automatically calculate and load Fibonacci levels onto a chart. A bearish pennant is a pattern that indicates a downward trend in prices.

The Best Technical Analysis Books to Learn About Short-term Trading – Business Insider

The Best Technical Analysis Books to Learn About Short-term Trading.

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

The resulting combination https://g-markets.net/ clearly displays how the temperature range each day compares to the historic average, and it even indicates how those measurements trend over the examined time period. The pattern formed by the plotted dots can clearly determine trends in the data. By analyzing a scatter plot, for example, a researcher could easily identify a correlation between longer life expectancy and higher household income. For example, an area chart with one axis that represents a numeric value, and another axis that serves as a timeline, data for various categories over time can be tracked and compared with a single graphic. Stacked area charts are ideal for comparing values that would normally require multiple line graphs.

Limitations of chart patterns

Just as in the cases of multi-level pie graphs, stacked bar graphs and trellis plots, multi-pie graphs paint a more detailed portrait of the data set it illustrates. A radar chart, also commonly referred to as a spider chart or a star chart, displays data sets consisting of three or more variables on a two-dimensional graphic. Each variable’s quantitative value is reflected across an axis that usually starts in the chart’s center point.

- The universally-recognized graph features a series of bars of varying lengths.

- Technical analysts use many such tools at their disposal to predict future movements in price that help traders book profits in a short period of time.

- Technical analysis can be used to identify, firstly, if the price is in a trend or just moving sideways.

Some common software programs used in data visualization for business include Excel, Tableau, Microsoft Power BI, and Google Charts. The chart displays low, high, and open prices apart from the closing prices for every period specified under the bar. However, we have discussed the top three in the article here, as many traders trust them and use the same worldwide. However, the same price action viewed on an hourly chart shows a steady downtrend that has accelerated somewhat just within the past several hours.

The opposite version, which occurs in a downtrend, is known as the inverse head and shoulder pattern. It consists of three swing lows and two swing highs, with the middle swing low being lower than the other two swing lows. When the pattern is completed — by breaking above the line joining the two swing highs which act as a resistance level — a bullish signal is generated. If the market’s opening price is below the closing price for the period, the bar chart will sometimes be colored green or black, representing security gain.

A type of multi-level pie chart, a sunburst chart is used to illustrate hierarchical data using concentric circles. Each ring of the “sunburst” represents a level in the hierarchy, with the root node represented by the center circle, and the hierarchy moving outward. A trellis plot, also called a lattice graph or plot, can display and compare all of those variables. While the above example uses a series of scatter charts, trellis plots commonly feature series of bar or line graphs, as well.

On the other hand, this can make market sentiment hard to determine. While this kind of chart doesn’t provide much insight into intraday price movements, many traders consider the closing price to be more important than the open, high, or low price within a given period. Among all the aspects of technical analysis, perhaps the most important and actionable concepts are support and resistance. Many other aspects of technical analysis, such as price patterns, are based on the key concepts of support and resistance.

Types of Graphs Perfect for Every Top Industry

The below types of charts in technical analysis of Ashok Leyland is plotted by using daily time frame on x-axis uses and price of Ashok Leyland on y-axis. A dot is placed for closing price of each day, and by connecting each of those dots the following line chart is formed. The regular charts like the column chart, pie chart, area chart etc. that we are generally use does not work for technical analysis because they display one data point at a given point in time. However, technical analysis requires four data points to be displayed at the same time, because each trading minute/day/week or month has four data points i.e. the OHLC – Open , high , low , and close . Charting can be a helpful tool for any trader but is particularly useful for those who are trying to identify patterns in price movement.

Double Bottom Pattern Explained Trading & Technical Analysis – Finbold – Finance in Bold

Double Bottom Pattern Explained Trading & Technical Analysis.

Posted: Thu, 13 Oct 2022 07:00:00 GMT [source]

This often results in a trend reversal, as shown in the figure below. Horizontal or slightly sloped trendlines can be drawn connecting the peaks and troughs between the head and shoulders, as shown in the figure below. Volume may decline as the pattern develops and spring back once the price breaks above or below the trendline. An uptrend interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend. Conversely, a downtrend that results in a head and shoulders bottom will likely experience a trend reversal to the upside.

The pattern consists of an initial swing high , a higher swing high , and a third swing high , which is lower than the preceding swing high . The pattern completes when the third swing turns downwards and breaks the neckline —the trendline connecting the troughs of the preceding swings. Profit targets simply are levels where you decide to exit a trade and take profit.

The graph of a function is the set of all points whose coordinates satisfy the equation. Particularly useful in accounting and qualitative analysis, waterfall charts illustrate how an initial value is affected positively and negatively by various factors. Oftentimes in business – as well as other industries – a process must be diagrammed.

Seasonality in the stock market is a characteristic of the market that explains why the stock market tends to perform better during certain periods of the year. When the price moves above the preceding swing high, the line changes color, and it’s called the Yang line. When it falls below the preceding swing low, it’s called the Yin line.

Pivot and Fibonacci levels are worth tracking even if you don’t personally use them as indicators in your own trading strategy. The typical doji is the long-legged doji, where price extends about equally in each direction, opening and closing in the middle of the price range for the time period. The appearance of the candlestick gives a clear visual indication of indecision in the market. When a doji like this appears after an extended uptrend or downtrend in a market, it is commonly interpreted as signaling a possible market reversal, a trend change to the opposite direction. Traders use chart patterns to identify stock price trends when looking for trading opportunities.